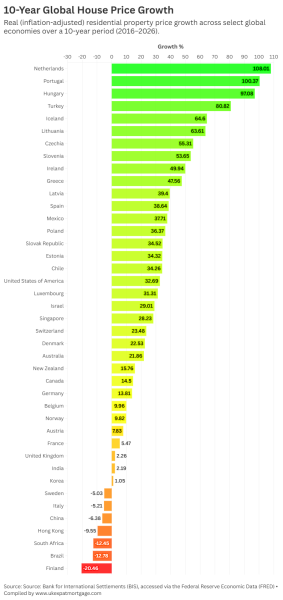

A study by UK Expat Mortgage examined inflation-adjusted house price changes across 41 countries from 2016 to 2026 using Bank for International Settlements data. The analysis found varied patterns across markets. The Netherlands saw a 108% real price increase, Portugal recorded 100.37%, and Hungary showed 97.08% growth. The United Kingdom experienced 2.26% real growth, the United States recorded 32.69%, and Australia saw 21.86%. Several markets experienced declines, including Finland at -20.46%, Sweden at -5.03%, and Italy at -5.21%. The study provides perspective on how property values changed when adjusted for inflation across different international markets.

United Kingdom, 5th Feb 2026 – UK Expat Mortgage has published a study examining inflation-adjusted house price changes across 41 countries over the past decade, using data from the Bank for International Settlements.

The analysis tracks real house price movements between Q1 2016 and February 2026, providing insight into how property values have changed when adjusted for inflation across different markets.

Study Findings

The research identified varied patterns in real house price movements across the countries examined. The Netherlands recorded a 108% increase in real house prices over the period, while Portugal saw a 100.37% increase and Hungary recorded 97.08% growth.

The United Kingdom experienced a 2.26% increase in real house prices over the decade. The United States recorded 32.69% real growth, while Australia saw a 21.86% increase.

Several markets experienced declines in real house prices. Finland recorded a -20.46% change, while Sweden saw a -5.03% movement and Italy experienced a -5.21% change.

Other notable figures include Ireland (49.94%), Greece (47.56%), Spain (38.64%), Mexico (37.71%), Singapore (28.23%), Canada (14.50%), Germany (13.81%), and France (5.47%).

“This study examines how house prices have moved in real terms across different markets when inflation is factored in,” said Luther Yeates, Head of Mortgages at UK Expat Mortgage. “Understanding real price movements provides a different perspective than looking at nominal figures alone.”

Methodology

The study analyzed House Price Index data from the Bank for International Settlements, accessed through the Federal Reserve Economic Data (FRED) database. The analysis compared Q1 2016 figures with the latest available data as of February 3, 2026, across 41 countries. All figures represent inflation-adjusted values to reflect real purchasing power changes.

About UK Expat Mortgage

UK Expat Mortgage is a specialist expat mortgage broker dedicated to helping British expatriates and foreign nationals secure mortgage finance in the UK and internationally.

For More Information

Web: www.ukexpatmortgage.com

Email: josh@ukexpatmortgage.com

Data Source: Federal Reserve Economic Data (FRED), Bank for International Settlements House Price Indices

Full country-by-country data available upon request.

Media Contact

Organization: UK Expat Mortgage

Contact Person: Josh Thompson

Website: https://www.ukexpatmortgage.com/

Email: Send Email

Country:United Kingdom

Release id:40982

The post New Study Examines Inflation-Adjusted House Price Changes Across 41 Countries from 2016-2026 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Euro Tidings journalist was involved in the writing and production of this article.